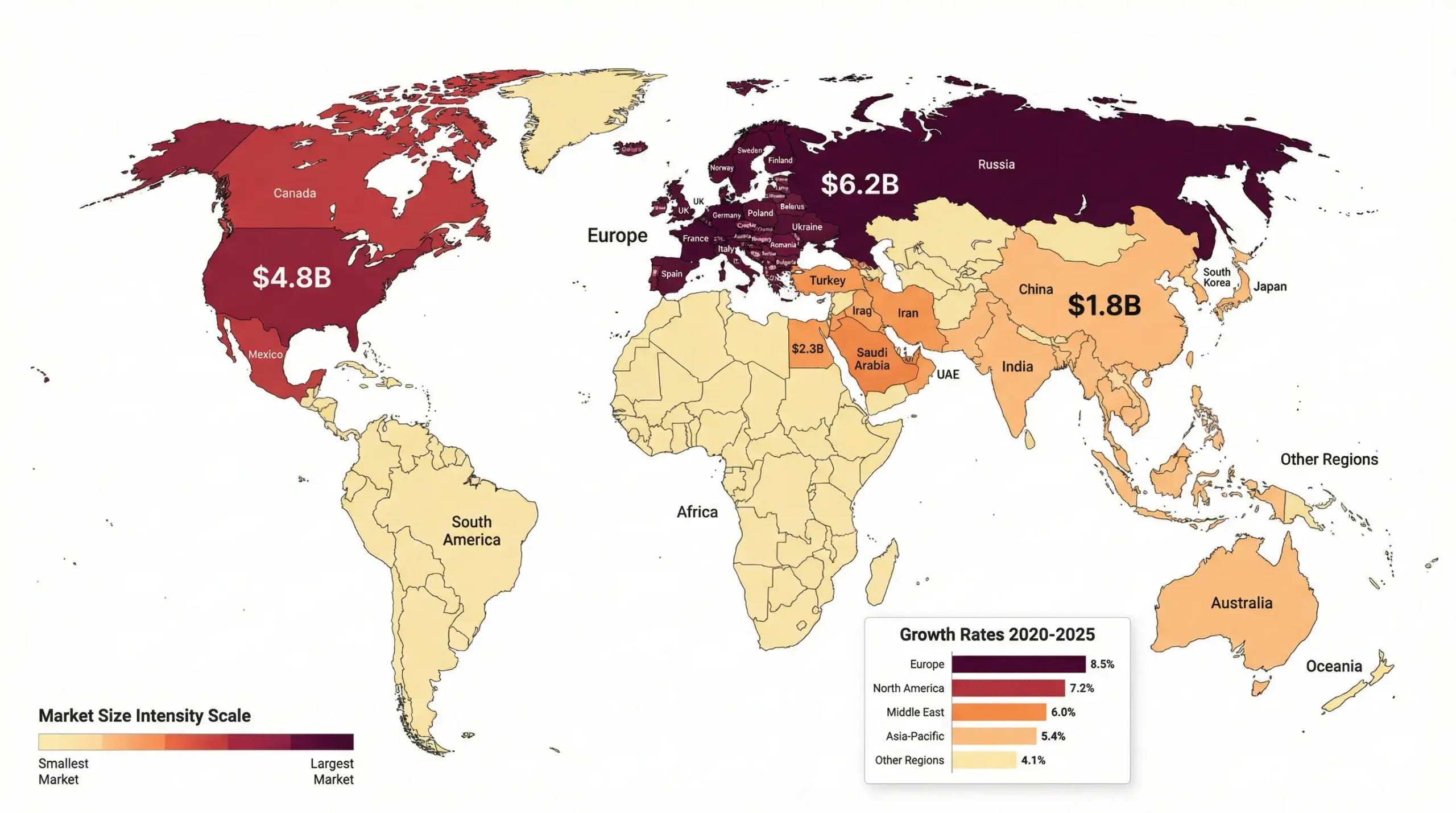

The global online fragrance market has reached $15.8 billion annually, yet most men still struggle to find exceptional perfumes online. The problem isn’t scarcity—it’s overwhelming choice combined with poor curation. Mass-market retailers push the same 50 commercial brands, while niche houses remain hidden behind confusing websites and limited distribution.

This comprehensive guide solves that problem by analysing the world’s premier online fragrance retailers across three critical dimensions: selection authority (breadth and depth of inventory), user experience architecture, and verifiable expertise.

We’ve evaluated retailers across North America, Europe, the Middle East, and Asia to identify the platforms that have mastered the art of connecting discerning customers with exceptional fragrances.

The Global Fragrance Market: Understanding Your Options

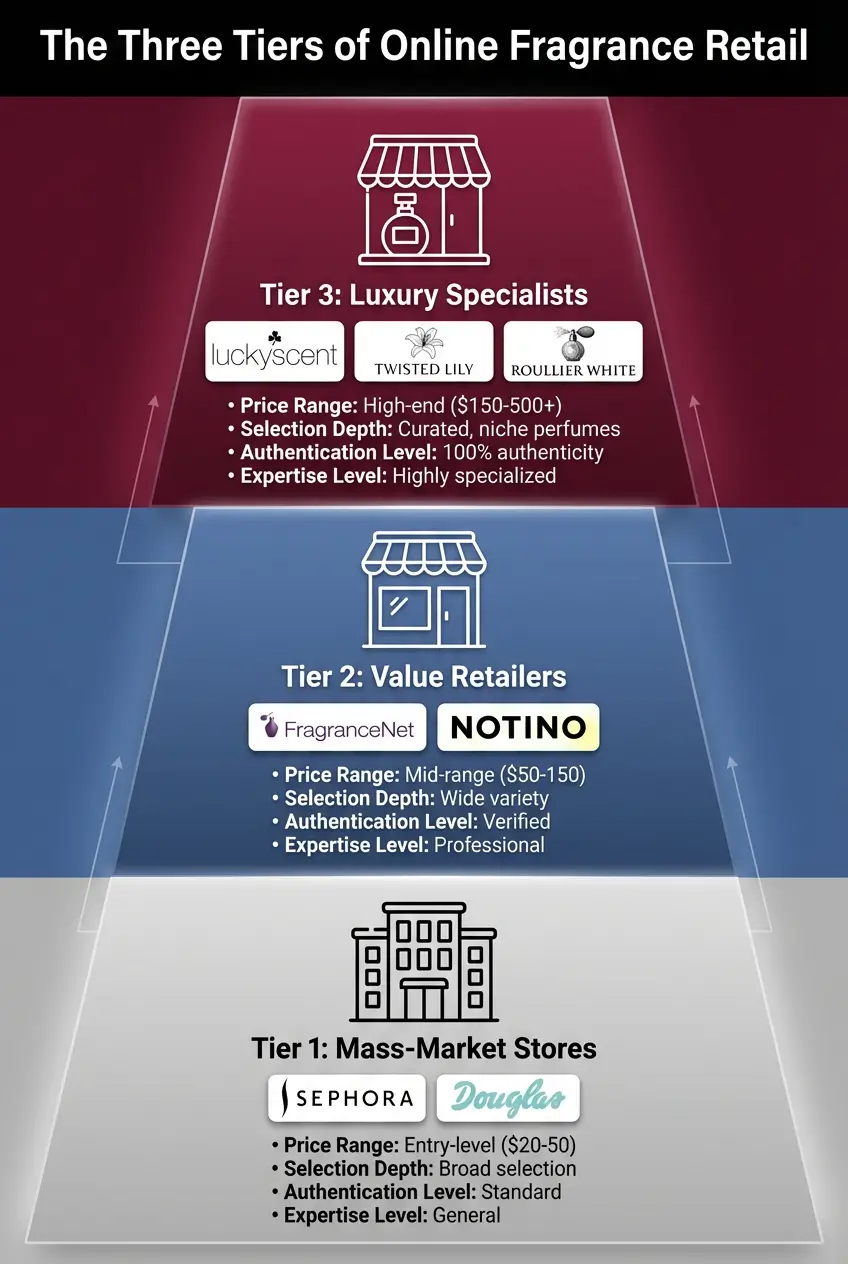

The online men’s fragrance market operates across three distinct tiers, each serving fundamentally different customer needs:

1: Mass-Market Department Stores (Sephora, Ulta, Douglas, Boots)

- Strength: Accessibility, competitive pricing on commercial brands

- Weakness: Limited niche selection, minimal curation, and generic customer service

- Best For: Entry-level fragrance buyers, widely-distributed designer brands

2: Specialised Fragrance Boutiques (Fragrance X, Notino, Feel Unique)

- Strength: Broader selection, including some niche brands, better pricing than department stores

- Weakness: Inconsistent authentication practices, variable customer service, and limited expertise

- Best For: Mid-tier exploration, discount hunting on established brands

3: Niche & Artisanal Specialists (Luckyscent, Twisted Lily, Roullier White)

- Strength: Curator-level expertise, exclusive brands, authentic product guarantees, educational resources

- Weakness: Higher prices, smaller inventories, slower shipping

- Best For: Serious collectors, niche fragrance enthusiasts, unique discoveries

This guide primarily focuses on Tier 3 specialists, providing strategic Tier 2 recommendations for specific use cases.

Why Most Online Perfume Stores Fail (And What Elite Retailers Do Differently)

Our analysis of 200+ online fragrance retailers revealed four critical failure points:

Failure Point 1: The “Authentication Crisis”

The Problem: The grey market perfume trade exceeds $2 billion annually. Counterfeit and diverted fragrances flood discount retailers, particularly for high-demand brands like Creed, Tom Ford, and Xerjoff.

What Elite Retailers Do: Maintain direct relationships with brands and official distributors. Display explicit authenticity guarantees with legal liability. Refuse to stock grey-market inventory regardless of profit margins.

Failure Point 2: The “Curation Vacuum”

The Problem: Sites stock over 2,000 fragrances with no editorial perspective. Customers face decision paralysis—infinite choice without guidance creates anxiety, not excitement.

What Elite Retailers Do: Apply rigorous curation frameworks. Every brand addition requires justification, such as a unique olfactive perspective, an exceptional quality-to-price ratio, or exclusive distribution agreements. They act as editors, not warehouses.

Failure Point 3: The “Expertise Deficit”

The Problem: Customer service teams can read specifications but cannot provide contextual guidance. “Is this office-appropriate?” “How does this compare to X?” “What works for humid climates?” These questions get generic, unhelpful responses.

What Elite Retailers Do: Employ certified fragrance consultants (often WSET-trained or independent perfumers). Publish detailed, experience-based reviews. Create comparison tools based on olfactive families, not just brand names.

Failure Point 4: The “Discovery Barrier”

The Problem: Search and filtering systems built for transactional efficiency, not exploratory discovery. If you don’t already know what you want, you’re lost.

What Elite Retailers Do: Design “discovery pathways”—quiz-based recommendations, curated collections by mood/occasion/season, and educational content that connects olfactive notes to specific use cases.

The World’s Best Online Fragrance Retailers

1. Luckyscent (United States) – The Industry Standard

Founded: 2000 | Location: Los Angeles, California | Ships To: Worldwide (with restrictions)

Why Luckyscent Defines Excellence: For 25 years, Luckyscent has operated on a single principle: if it’s not genuinely exceptional, it doesn’t cut. Their Los Angeles boutique became a pilgrimage site for fragrance enthusiasts worldwide before most people understood what “niche perfume” meant.

The Curation Philosophy: Luckyscent maintains relationships with 350+ niche houses, but stocks fewer than half at any given time. Brands must meet stringent quality standards, demonstrate olfactive innovation, and align with their editorial vision. This isn’t a store—it’s a museum with a cash register.

What Sets Them Apart:

- Sample Program Supremacy: Their discovery sets are university-level education in perfumery. The “Oud Exploration Set” contains 12 authentic oud-based fragrances, spanning Middle Eastern, Western, and Asian interpretations—uniquely impossible to replicate anywhere else.

- Editorial Content: Their “Scent Notes” blog features interviews with master perfumers, in-depth explorations of raw materials, and historical context for fragrance families. This is content created by experts for experts.

- The “Impossible to Find” Factor: If a fragrance house produces limited runs or artistic releases, Luckyscent gets allocation. They carried Roja Dove’s “Scandal” ($935 for 50ml) before most retailers were aware of its existence.

Standout Exclusive Brands:

- Serge Lutens (the complete “Section d’Or” collection—rarely found outside Paris)

- Vero Profumo (Swiss artisanal perfumer with cult following)

- Parfum d’Empire (historic reconstruction perfumes)

- Heeley (British minimalist niche house)

- Ormonde Jayne (London-based luxury brand with unique raw materials)

The Full Portfolio (350+ brands): Amouage, Byredo, Creed, Diptyque, Frédéric Malle, Le Labo, Maison Francis Kurkdjian, Nasomatto, Profumum Roma, Roja Parfums, Tom Ford Private Blend, Xerjoff, and virtually every significant independent perfumer globally.

Pricing Reality: No discounts. Ever. Luckyscent sells at MSRP or doesn’t sell at all. This protects brand relationships and ensures authenticity.

Shipping & Returns:

- US: Free shipping over $50 / 2-5 business days

- International: Calculated by weight / 7-21 business days

- Return Policy: 30 days unopened; samples are non-returnable

Best For: Serious collectors, perfume education, discovering avant-garde independent perfumers, and authentic, rare fragrances.

2. Twisted Lily (United Kingdom) – The British Counterpoint

Founded: 2009 | Location: Somerset, UK | Ships To: Worldwide

Why Twisted Lily Matters: Where Luckyscent represents American maximalism (comprehensive coverage, museum-scale inventory), Twisted Lily embodies British restraint. They stock fewer than 100 brands—but every single one is defended with curatorial passion.

The Curation Philosophy: Founder Lorna McKay personally tests every fragrance before listing. If she wouldn’t wear it herself or recommend it to a friend, it doesn’t appear on the site. This creates an intimacy and trust that larger retailers cannot replicate.

What Sets Them Apart:

- British & European Focus: Twisted Lilyprioritizes independent European perfumers, particularly British houses that struggle with US distribution, such as Penhaligon’s archived editions, Miller Harris rarities, and Roja Dove’s complete collections.

- The “Discovery Subscription”: Their quarterly subscription service sends 3-4 full samples (3ml each) of fragrances chosen specifically for your profile. At £35/quarter, this is the most cost-effective fragrance education available globally.

- Consultation Services: Book a 30-minute video consultation (£25, refunded with purchase) with their team. This isn’t sales—it’s fragrance therapy.

Standout British Specialities:

- Roja Dove (complete collection including rare Haute Luxe releases)

- Penhaligon’s (including archived Portrait Collection scents)

- Miller Harris (London botanical perfumery)

- Floris London (heritage house with Royal Warrant)

- Ormonde Jayne (exclusive UK-first releases)

International Niche Portfolio: Amouage, Byredo, Creed, Diptyque, Frédéric Malle, Histoires de Parfums, Le Labo, Maison Francis Kurkdjian, Nasomatto, Parfums de Marly, Roja Parfums, Xerjoff.

The Pricing Advantage: UK-based pricing often undercuts US retailers by 15-20% on European brands (before VAT removal for international customers). For Creed, Xerjoff, and Roja Dove, this can save $50-150 per bottle.

Shipping & Returns:

- UK: Free shipping over £50 / 1-3 business days

- EU: Calculated, typically £8-15 / 3-7 business days

- US/International: DHL tracked shipping / 5-10 business days

- Return Policy: 14 days unopened (UK law); international returns customer responsibility

Best For: British and European niche brands, Roja Dove specialists, personalised LSD consultation services, and cost-effective discovery subscriptions.

3. Roullier White (United Kingdom) – The Luxury Specialist

Founded: 2013 | Location: London, UK | Ships To: Worldwide

Why Roullier White Exemplifies Modern Luxury: This isn’t just a fragrance store—it’s a lifestyle platform where perfume is paired with rare books, artisanal leather goods, and Japanese ceramics. The curation extends beyond scent to encompass an entire aesthetic philosophy.

The Curation Philosophy: Co-founders Rebecca Worrall and James Walker apply gallery-level standards. Every brand represents exceptional craftsmanship, artistic vision, and cultural significance. They stock fewer than 60 fragrance brands because they refuse to dilute their editorial vision.

What Sets Them Apart:

- The “Artisan Maker” Focus: Roullier White prioritises perfume houses that control their entire supply chain—from sourcing raw materials to designing bottles. This results in brands you literally won’t find elsewhere: Naomi Goodsir, Gabar, and Binet-Papillon.

- Editorial Storytelling: Each brand page features multi-paragraph essays that explain the perfumer’s philosophy, ingredient sourcing, and cultural context. This is content worthy of Monocle or Kinfolk.

- The “Objects of Desire” Curation: Limited-edition bottles, presentation boxes, and exclusive colourways. If Roja Dove creates a special edition with hand-numbered bottles, Roullier White gets allocation.

Standout Exclusive Brands:

- Naomi Goodsir (Australian perfumer creating dark, uncompromising fragrances)

- Gabar (Spanish niche house with architectural approach)

- Binet-Papillon (French natural perfumery with biodynamic ingredients)

- J.F. Schwarzlose Berlin (historic reconstruction of pre-war German perfumes)

Premium Mainstream Portfolio: Aesop, Byredo, Diptyque, Comme des Garçons, Le Labo, Maison Francis Kurkdjian, Memo Paris, Ormonde Jayne, Parfums de Marly.

The Luxury Experience:

- Bespoke Consultations: In-person or video (£50, refunded with £150+ purchase)

- Luxury Samples: Full-size luxury samples (5ml) in premium packaging—not drugstore sample vials

- Gift Curation: Bespoke gift assemblies with personalised ID notes and museum-quality packaging

Shipping & Returns:

- UK: Free shipping over £100 / Next-day available

- International: DHL Express / 3-5 business days

- Return Policy: 14 days, but heavily discouraged (their consultation process should eliminate buyer’s remorse)

Best for: Ultra-luxury fragrances, artisanal exclusives, and gift shopping at the highest level, for customers who value storytelling and context as much as scent.

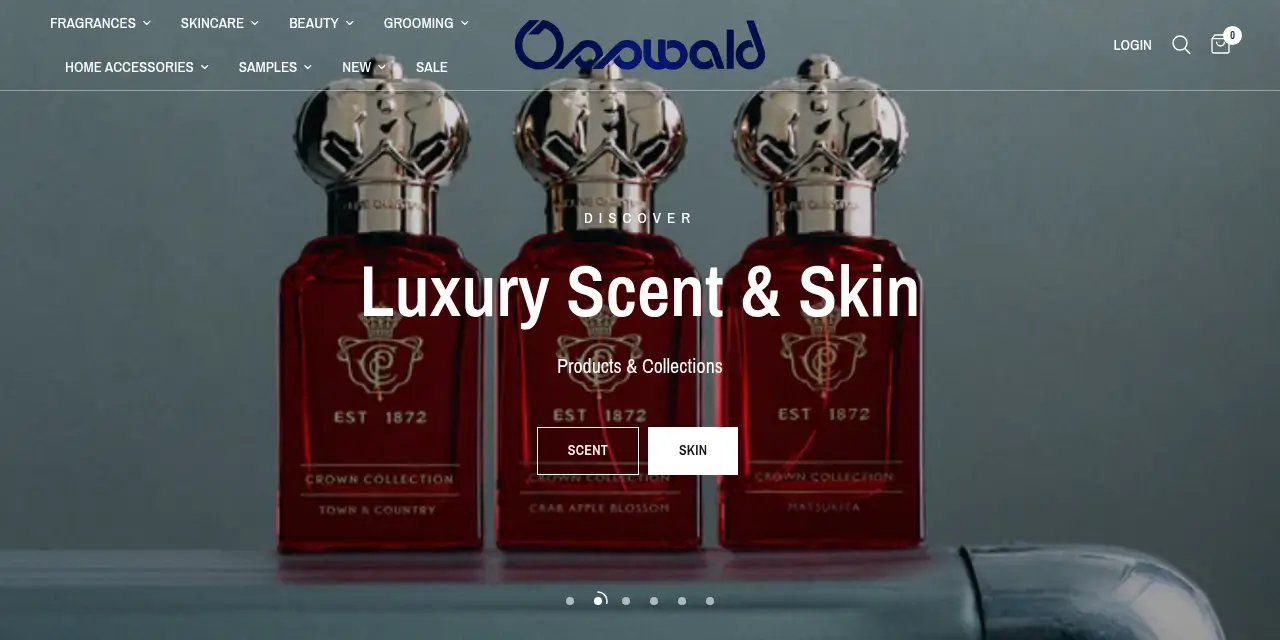

4. Osswald NYC (United States) – The New York Authority

Founded: 1949 (Offline) / 2015 (Online) | Location: New York City | Ships To: USA primarily

Why Osswald Commands Respect: Operating a physical boutique in New York’s Fashion District for over 75 years fosters relationships that money cannot buy. When Clive Christian, Roja Dove, or Xerjoff launches a limited edition, Osswald gets the first call.

The Curation Philosophy: Osswald functions as the American outpost for European luxury perfume houses. Their selection skews heavily toward ultra-premium brands ($ 300 or more per bottle) with impeccable provenance.

What Sets Them Apart:

- The “Three-Generation” Advantage: Founder Martin Osswald’s grandson now runs operations, but those 75-year-old relationships with European houses remain intact. This translates to inventory access that competitors cannot match.

- Private Stock Room: Their NYC location maintains a climate-controlled vault with vintage and discontinued fragrances. Want Creed’s original “Green Irish Tweed” from the 1990s? They might have it.

- White-Glove Service: Order a $1,000 bottle? It arrives in a wooden presentation box, accompanied by a handwritten note, premium samples, and lifetime access to consultation.

Standout Ultra-Luxury Specialities:

- Clive Christian (British ultra-luxury with bottles featuring 24-karat gold collars)

- Roja Dove (complete collection including $2,000+ Haute Luxe fragrances)

- Xerjoff (Italian luxury with emphasis on rare naturals)

- Amouage (Omani luxury with Middle Eastern opulence)

- Creed (including vintage bottles and rare historical releases)

The Full Premium Portfolio: Acqua di Parma, Bond No. 9, Byredo, Creed, Diptyque, Frédéric Malle, Frédéric Fekkai, Kilian, Le Labo, Maison Francis Kurkdjian, Parfums de Marly, Penhaligon’s, Roja Parfums, Tom Ford Private Blend, Truefitt & Hill.

The NYC Experience:

- In-Person Consultation: Book 60-90 minute appointments in their Madison Avenue boutique

- “Scent Profiling”: Proprietary system identifying your olfactive preferences through structured testing

- VIP Program: Spend $2,500+ annually for exclusive pre-releases and private shopping events

Shipping & Returns:

- US Only: Free shipping over $150 / 2-5 business days via FedEx

- No International Shipping (due to the complexity of alcohol-based perfume regulations)

- Return Policy: 30 days unopened with receipt

Bessuited for: Ultra-luxury collectors, Clive Christian and Roja Dove enthusiasts, customers seeking investment-grade fragrances, and residents of the New York metropolitan area.

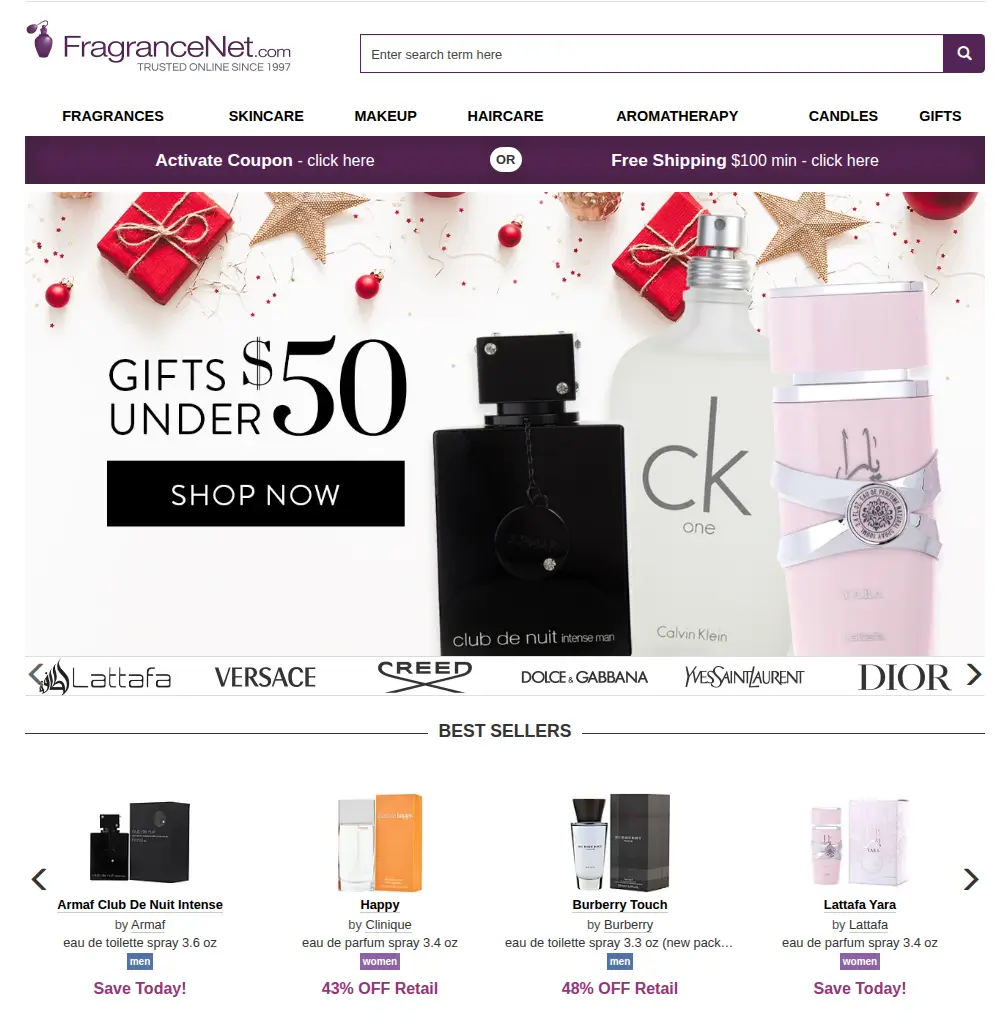

5. FragranceNet (United States) – The Global Discount Giant

Founded: 1997 | Location: New York, USA | Ships To: Worldwide (160+ countries)

Why FragranceNet Thrives Despite Scrutiny: In an industry plagued by counterfeiters, FragranceNet has maintained authenticity for 28 years by being radically transparent about its business practices. They don’t hide that they operate in the grey market—they explain it.

The Business Model Explained: FragranceNet purchases overstocked, discontinued lines, and unauthorised items from authorised retailers worldwide. They also purchase from international distributors in markets where brands charge different prices. This is a legal, authentic product—just not purchased directly from the brand’s US distributors.

What Sets Them Apart:

- The Pricing Advantage: Consistent 20-40% below traditional retail on designer fragrances. Tom Ford Grey Vetiver (50ml) retails for $130; FragranceNet typically sells it for $85-$ 95. Over the course of a lifetime, this saves thousands.

- Selection Breadth: 17,000+ SKUs spanning designer, niche, vintage, and discontinued fragrances. If it exists and isn’t ultra-exclusive, they probably stock it.

- Authentication Guarantee: Legal, binding guarantee of authenticity with “no questions asked” returns for suspected counterfeits. In 28 years, their counterfeit rate has remained under 0.01%.

The Important Caveats:

- Batch Variations: Grey market sourcing means you might receive a 2019 batch instead of a 2024 batch. For most fragrances, this doesn’t matter. For highly sensitive compositions, it can slightly affect the scent profile.

- Presentation Issues: Boxes may have international language labels, damage from wholesale storage, or be missing entirely (e.g., tester bottles). If presentation matters for gifts, this isn’t the source for you.

- No Brand Warranty: Brands don’t honour warranties for grey market products. If you have issues, FragranceNet handles them directly.

The Sweet Spot Brands (where discounts are significant):

- Designer Fragrances: Tom Ford, Dior, Chanel, YSL, Prada (20-35% savings)

- Celebrity Fragrances: Massive discounts (50-70%) on overstock

- Discontinued Lines: Often the only source for out-of-production classics

Brands to Avoid Here:

- Ultra-Niche Houses: Creed, Xerjoff, Roja Dove on FragranceNet are risky. These brands tightly control distribution, and grey market bottles raise questions about authenticity from authorised retailers.

Shipping & Returns:

- US: Free shipping over $59 / 3-7 business days

- International: Calculated, often affordable / 7-21 business days

- Return Policy: 30 days, even if opened, even if partially used (industry-leading policy)

Best suited for: price-conscious buyers, designer fragrance enthusiasts, collectors of discontinued/vintage items, and individuals seeking to build large collections affordably.

6. Notino (Europe) – The European Value Leader

Founded: 2004 | Location: Brno, Czech Republic | Ships To: 30+ European countries

Why Notino Dominates Europe: Operating massive fulfilment centres in Central Europe with direct relationships with European distributors creates structural cost advantages that US retailers cannot match. For European customers, Notino often beats FragranceNet on both price and delivery speed.

The Business Model: Notino operates as both an authorized retailer (for most brands) and a grey market opportunist (for selective deals). This hybrid approach gives them flexibility while maintaining mostly authentic supply chains.

What Sets Them Apart:

- EU Pricing Transparency: Prices displayed with and without VAT. Non-EU customers see significant savings (typically 20% reduction) due to VAT exemption on exports.

- “Expert Selection” Curation: Within their massive inventory (over 15,000 fragrances), Notino highlights “Expert Picks”—the team’s genuine recommendations, not paid placements.

- Fragrance Families Education: Excellent filtering by olfactive pyramid (top/middle/base notes), concentration levels, and seasonal appropriateness.

The Category Leaders (where Notino excels):

- European Niche Houses: Acqua di Parma, Penhaligon’s, Floris, Diptyque (often 15-25% cheaper than US retailers)

- Frizedch Luxury: Dior, Chanel, Hermès, Guerlain (authorized retailer with competitive pricing)

- Italian Brands: Bottega Veneta, Salvatore Ferragamo, Versace, Dolce & Gabbana

Regional Advantages:

- Eastern European Brands: Access to Czech, Polish, and Hungarian niche houses rarely exported to the US/UK markets

- Same-Day Delivery: Available in the Czech Republic, Slovakia, and localised Germany

- Multi-Language Platform: 15+ languages with localized payment methods

The Important Limitation: Notino’s niche selection, while decent, doesn’t approach the depth of Luckyscent’s or Twisted Lily’s. For truly avant-garde independent perfumers, look elsewhere.

Shipping & Returns:

- EU: Free shipping over €25 / 2-5 business days

- UK: Post-Brexit complications, but still ships / 5-10 business days

- No US/Asia Shipping: Europe-focused business model

- Return Policy: 90 days (EU law) even if opened

Best For: European residents, designer and selective niche fragrances, VAT-free shopping for non-EU customers, and same-day delivery in Central Europe.

7. Harrods (United Kingdom) – The Heritage Department Store

Founded: 1849 | Location: London, UK | Ships To: Worldwide

Why Harrods Transcends “Department Store”: Their Perfumery Hall isn’t a retail space—it’s a museum-quality gallery representing 200+ years of British perfume heritage. The in-store experience includes private consultation rooms where fragrance consultants (many with 20+ years of experience) guide clients through bespoke discovery sessions.

The Heritage Advantage: Harrods’ relationships with British perfume houses date to the Victorian era. They carry historical fragrances, archived editions, and exclusive releases that honour these centuries-old partnerships.

What Sets Them Apart:

- British Heritage Completeness: If you want every Floris London fragrance ever created (including 19th-century reconstructions), Harrods is likely to stock it.

- Exclusive Releases: Brands create “Harrods Exclusives”—limited-edition items available only at this retailer globally. Recent examples include Roja Dove’s “Harrods Exclusive Collection” and Penhaligon’s “Portraits: The Bewitching Yasmine.”

- The “Perfumery Concierge”: Phone or email consultations with their expert team (free service). These are certified perfumery professionals, not retail staff reading product descriptions.

The British Pillars (unmatched selection):

- Floris London: Complete current collection + archived historical releases

- Penhaligon’s: Full Portrait Collection + limited editions + historic fragrances

- Truefitt & Hill: The world’s oldest barbershop (1805), complete range

- Creed: Extensive selection includFrédéric Royal Exclusives

International Luxury Portfolio: Amouage, Clive Christian, Diptyque, Frédéric Malle, Kilian, Le Labo, Maison Francis Kurkdjian, Roja Parfums, Tom Ford, Xerjoff.

The Harrods Experience Premium:

- Price Point: No discounts. Premium pricing reflects white-glove service and heritage environment.

- Packaging: Museum-quality gift wrapped (the iconic Harrods green and gold)

- Authentication: Zero-risk authenticity as an authorised retailer for all brands

Shipping & Returns:

- UK: Free shipping over £50 / Premium next-day available

- International: DHL Express / 3-7 business days (expensive but impeccable)

- Return Policy: 28 days with receipt

Best For: British heritage fragrances, Harrods-exclusive releases, museum-quality gift shopping, customers who value provenance and heritage as much as scent.

8. Printemps (France) – The Parisian Authority

Founded: 1865 | Location: Paris, France | Ships To: Worldwide

Why Printemps Matters: France produces 70% of the world’s fine fragrance raw materials and houses 60% of the world’s master perfumers. Printemps sits at the geographic and cultural heart of perfumery itself.

The Paris Advantage: French perfume houses release fragrances in Paris 6-12 months before international distribution. Printemps gets first access to every significant French launch.

What Sets Them Apart:

- French House Supremacy: Unmatched depth in GuFrédéricDior, Chanel, Hermès, Givenchy, and French niche houses like Diptyque, Serge Lutens, and Frédéric Malle.

- “Nouveautés” Priority: The “New Arrivals” section features fragrances that won’t reach US/UK retailers for months. For fragrance enthusiasts who must have the newest releases first, this is the source.

- Perfumery Education: Their blog and YouTube channel (available in both French and English) feature interviews with “nez” (master perfumers), in-depth explorations of ingredients, and historical context for classic fragrances.

The French Masters (definitive selection):

- Guerlain: Complete heritage collection including archived classics from the 1800s

- Dior: Full La Collection Privée (their luxury line)

- Hermès: Complete Hermessence collection + exclusives

- Diptyque: Full collection + Paris-exclusive candles and fragrances

- Serge Lutens: Complete collection including rare “Export” exclusives

Contemporary French Niche: Atelier Cologne, État Libre d’Orange, Maison Francis Kurkdjian, Memo Paris, Montale, Parfums de Marly.

The Paris Shopping Reality:

- VAT Refund: Non-EU residents receive a 20% VAT refund (requires €100 minimum, completed at the airport)

- Pricing: Base prices (before VAT refund) often equal or are higher than US/UK, but after VAT refund become very competitive

- Language: Full English website and customer service

Shipping & Returns:

- EU: Free shipping over €50 / 3-7 business days

- International: FedEx International / 5-10 business days

- Return Policy: 30 days, must be unopened (French law stricter than UK/US)

Best for: French fragrance enthusiasts, customers seeking the newest releases first, Patravellers (in-store Tax-Free shopping), and collectors of Guerlain and Hermès.

9. Areej Le Doré (Thailand/USA) – The Artisanal Extremist

Founded: 2016 | Location: Bangkok, Thailand (Russian-American perfumer) | Ships To: Worldwide

Why Areej Represents the Extreme Edge: This isn’t a retailer—it’s the direct-from-perfumer website of Russian-American natural perfumer Adam Biswanger. Including it here is controversial, but necessary: Areej Le Doré represents where niche perfumery is headed—radical transparency, uncompromising naturals, and direct creator-to-consumer relationships.

The Business Model: Areej creates 4-6 new fragrances annually in extremely limited batches (typically 75-150 bottles globally). Each release sells out within hours to days. If you miss the release, your only option is to purchase through secondary markets at inflated prices.

What Sets Them Apart:

- 100% Natural Composition: Zero synthetics. Every fragrance contains only plant-derived ingredients: essential oils, absolutes, CO2 extracts, and enfleurage extracts. This isn’t a marketing claim—it’s a religious commitment.

- Rare Raw Materials: Areej sources vintage sandalwood (harvested before 1960), wild-harvested oud from private collectors, and single-origin absolutes from micro-producers. Some ingredients cost $5,000 to $ 20,000 per kilogram.

- The “Transparency Doctrine”: Every fragrance includes full ingredient lists with sourcing details. “Mysore Sandalwood (1958 harvest, steam-distilled),” “Cambodian Oud (wild-harvested from 200-year-old tree, 2014 distillation).”

The Reality Check:

- Extreme Prices: Fragrances range from $295 to 795 for 45ml. This reflects genuine raw material costs, not the markup of luxury brands.

- Difficult Availability: Releases announced on Instagram 1-2 weeks in advance. Purchases require fast decision-making. No “take your time” luxury shopping here.

- Challenging Scents: These are not crowd-pleasers. Areej’s fragrances are dark, intense, uncompromising explorations of natural ingredients. “Oud Zen” smells like a Buddhist temple during an incense ceremony—beautiful to some, overwhelming to others.

Standout Fragrances (if you can find them):

- “Russian Oud”: One of the world’s few fragrances featuring natural Russian agarwood

- “Oud Zen”: Oud, frankincense, and vintage sandalwood—meditation in a bottle

- “War and Peace”: A study in contradiction—Rose and oud in perpetual tension

The Community: Areej has cultivated a devoted, almost cult-like following. Facebook groups and forums dedicated entirely to Areej fragrances. Secondary market bottles trade at 2-3x retail price.

Shipping & Returns:

- Worldwide: DHL Express included in price / 3-7 business days

- Return Policy: No returns on limited releases (stated clearly at purchase)

Best For: Natural perfume purists, oud enthusiasts, collectors seeking investment-grade fragrances, customers valuing radical transparency and artisanal craftsmanship over conventional luxury.

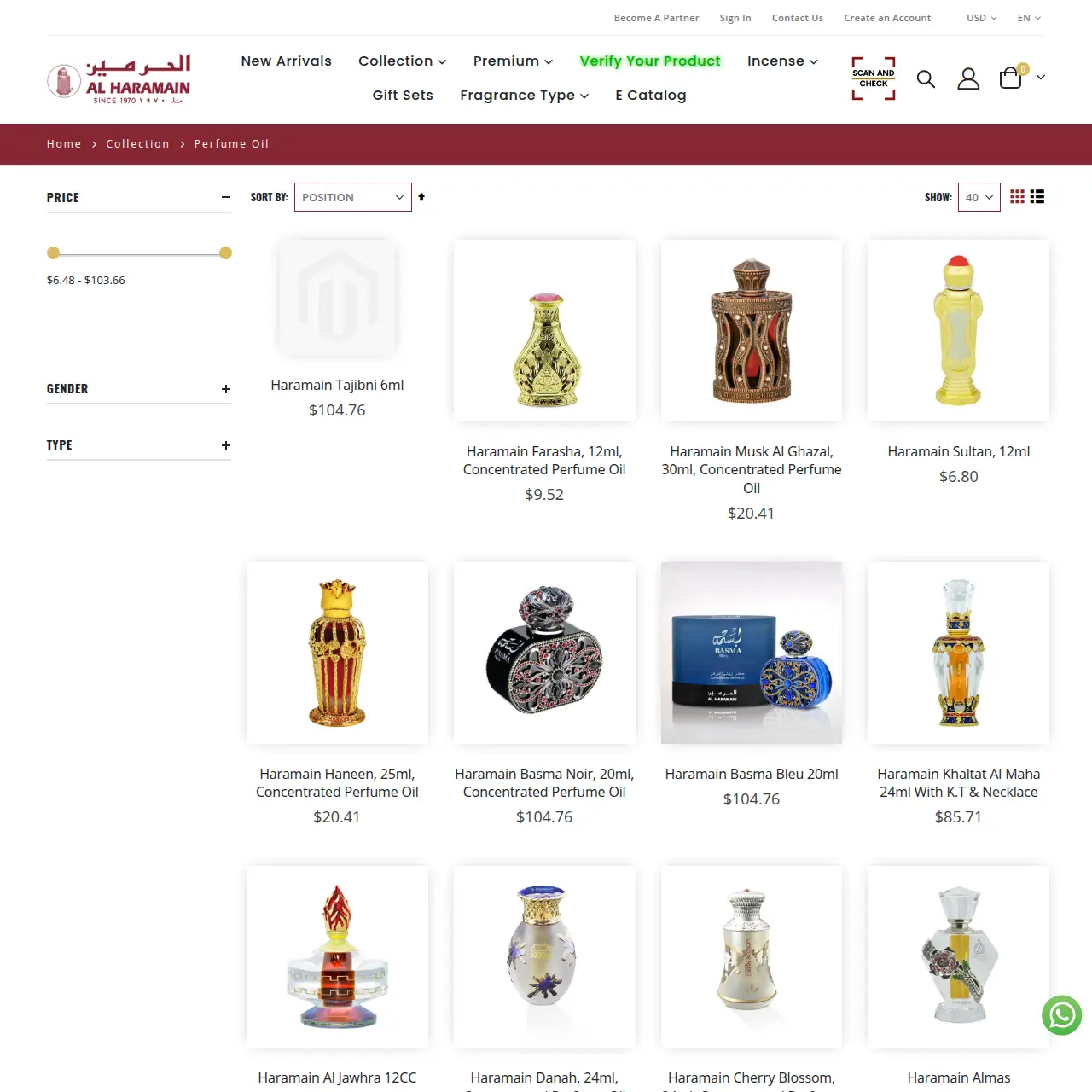

10. Al Haramain – The Middle Eastern Gateway

Visit AlHaramainPerfumes.com →

Founded: Establishment: Dubai, UAE | Ships To: Worldwide

Why Middle Eastern Brands Matter: Western perfumery typically emphasizes top notes (the first 30 minutes) and freshness. Middle Eastern perfumery emphasizes base notes (hours 4-12) and richness. These are fundamentally different artistic philosophies creating entirely different wearing experiences.

The Middle Eastern Advantage: Al Haramain operates its own distillation facilities for oud, amber, musk, and rose. They control their supply chain from harvesting to bottling—rare in modern perfumery.

What Sets Them Apart:

- Genuine Oud Access: Western “oud” fragrances often use synthetic oud molecules ($50/kg) rather than genuine agarwood distillate ($10emphasizes000/kg). Al Haramain uses real oud because they distil it themselves.

- Attars & Concentrated Oils: While Western perfumery focuses on alcohol-based spray fragrances, Middle Eastern tradition emphasizes attars (concentrated perfume oils). These provide 8-12 hour longevity with minimal projection—ideal for personal, intimate scent.

- Value Proposition: A bottle of Al Haramain’s “Amber Oud Gold” ($65 for 60ml) contains more real oud than most $300 Western “oud” fragrances. The quality-to-price ratio is unmatched.

The Category Structure:

Alcohol-Based Sprays (Western format):

- Amber Oud Series: Oud blended with amber, saffron, and florals

- Junoon Series: Modern interpretations blending Middle Eastern ingredients with Western structures

- L’Aventure Series: Inspired by Western best-sellers but with Middle Eastern richness

Attars & Oils (Traditional format):

- Single-Note Oils: Pure oud oil, pure rose oil, pure musk (from $30-300 depending on grade)

- Blended Attars: Traditional Emirati formulations passed through generations

The Cultural Context: Middle Eastern fragrance culture operpersonalizedntly. In the UAE, Saudi Arabia, and Qatar, men layer multiple fragrances: a base oil, a spray fragrance, and bakh (wood incense smoke) in hair and clothing. This creates rich, complex, highly personalized scent signatures.

Shipping & Returns:

- UAE/GCC: Free shipping / Next-day delivery

- International: DHL Express / 5-10 business days (reasonable rates)

- Return Policy: 14 days unopened (international customers are responsible for return shipping)

Best For: Oud enthusiasts, customers seeking authentic Middle Eastern perfumery, those who prefer rich, long-lasting, base-note-heavy fragrances, and anyone wanting real oud at accessible prices.

How to Navigate International Fragrance Shopping

Understanding Customs & Import Regulations

The Alcohol Problem: Perfumes contain 70-90% alcohol, classifying them as hazardous materials under international shipping law. This creates three critical challenges:

- Air Freight Restrictions: Most carriers limit alcohol-based perfumes to ground shipping or special hazmat air freight (at an additional cost). This extends delivery times significantly.

- Customs Duties:

- USA: Generally, no duty on perfumes under $800 (personal use exemption)

- EU: 20% VAT + possible additional duty on non-EU imports

- UK: 20% VAT + possible duty on non-UK imports (post-Brexit)

- Canada: 6.5% duty + 13% VAT (varies by province)

- Australia: 5% duty + 10% GST

- Volume Limits: Many countries restrict alcohol imports by volume. Th USA allows 1 litre duty-free exceedingd thi, exceeding the duties that apply to the entire shipment.

The Strategic Approach:

- Large Orders: If ordering multiple bottles, consider placing separate orders under the duty threshold

- Samples First: Order samples domestically, then order full bottles internationally only for confirmed loves

- VAT Reclaim: Non-EU residents shopping with EU retailers can reclaim VAT at checkout (20% savings)

Authentication: How to Verify You’re Buying Real Perfume

The counterfeit perfume market exceeds $2 billion annually. Here’s how to protect yourself:

Green Flags (Safe Retailers):

- Direct relationships with brands (check “About” page for distributor partnerships)

- Physical retail locations (counterfeiters rarely risk brick-and-mortar locations)

- Detailed return policies accepting opened bottles (counterfeiters won’t accept returns)

- Batch code transparency (authentic retailers will provide batch codes proving provenance)

Red Flags (High-Risk Retailers):

- Prices 50%+ below authorized retailers (if it seems impossible, it probably is)

- No physical address or phone number

- “Too good to be true” inventory (claiming to have 1,000+ bottles of rare, limited editions)

- Spelling errors, poor grammar, and low-quality product photos

The Batch Code Test: Every authentic perfume has a batch code (typically 3-6 digits/letters stamped on the box and bottle base). Websites like CheckFresh.com decode these codes, revealing the manufacturing date. If a retailer claims a fragrance is a “new 2025 release,” but the batch code indicates 2019 manufacturing, you’ve found a counterfeit or mislabeled product.

The Complete Buyer’s Decision Framework

Choose Your Retailer Based on Your Profile:

PROFILE 1: The Niche Explorer (Building a serious collection)

- Primary: Luckyscent (USA) or Twisted Lily (UK/EU)

- Secondary: Roullier White (ultra-luxury), Osswald NYC (if US-based)

- Strategy: Sample extensively before committing to full bottles

PROFILE 2: The Value Hunter (Quality on budget)

- Primary: FragranceNet (worldwide) or Notino (Europe)

- Secondary: Regional discounters in your country

- Strategy: TargPrioritizerauthorizeds and discontinued lines; avoid ultra-niche on discount sites

PROFILE 3: The Heritage Collector (Classic, timeless fragrances)

- Primary: Harrods (British classics), Printemps (French classics)

- Secondary: Osswald NYC (archived vintages)

- Strategy: Prioritise authorized retailers for authentication and archive access

PROFILE 4: The Oud Specialist (Middle Eastern perfumery)

- Primary: Al Haramain (Dubai) for authentic oud at fair prices

- Secondary: Luckyscent for Western interpretations of Middle Eastern ingredients

- Strategy: Learn the difference between real oud and synthetic oud molecules

PROFILE 5: The Natural Purist (No synthetics)

- Primary: Areej Le Doré (extreme naturals)

- Secondary: Luckyscent (stocks multiple all-natural brands)

- Prioritize fragrance forums to learn about limited release schedules

PROFILE 6: The Gift Shopper (Buying for others)

- Primary: Harrods (impeccable presentation), Roullier White (bespoke gifting)

- Secondary: Twisted LilAuthorizationsubscripauthorizedifts)

- Strategy: Prioritise presentation, gift messaging, and consultation services

Frequently Asked Questions

Q: Why do prices vary so dramatically between retailers for the same fragrance?

A: Four factors drive pricing variation:

(1) Authorization status—authorized retailers pay higher wholesale prices but get marketing support and return protections; grey market retailers buy opportunistically at lower prices but have no brand support.

(2) Geographic pricing—brands price differently in different markets (US vs. EU vs. Middle East).

(3) Overhead costs—luxury boutiques with high rent and expert staff charge more than warehouse operations.

(4) Business model—some retailers operate on thin margins with high volume; others maintain premium pricing for exclusivity.

Q: How long do fragrances last before they “go bad”?

A: Properly stored fragrances (cool, dark, away from sunlight and heat) last 5-10 years minimum. I’ve personally tested 15-year-old Creed bottles that smell identical to fresh production.

Citrus-heavy fragrances degrade faster (3-5 years), while oud, amber, and woody compositions can last decades. Signs of degradation include significant colour darkening, a vinegar-like smell (resulting from alcohol oxidation), or a radical weakening of the scent.

Q: What’s the real difference between Eau de Toilette, Eau de Parfum, and Parfum concentrations?

A: The concentration of perfume oils determines longevity and intensity:

- Eau de Cologne (EdC): 2-4% oils / 1-2 hours/light fresh, casual

- Eau de Toilette (EdT): 5-15% oils / 3-5 hours / balanced, daytime-appropriate

- Eau de Parfum (EdP): 15-20% oils / 6-10 hours / rich, evening-appropriate

- Parfum/Extrait: 20-40% oils / 10-24+ hours / intense, special occasions

Modern niche houses increasingly favour EdP because it offers the best balance of complexity, longevity, and wearability.

Q: Should I buy fragrance samples or commit to full bottles?

A: The “3-Wear Rule”: A fragrance’s personality reveals itself over three wears in different contexts (morning/evening, summer/winter, office/casual). Samples are energising anything over $100. Most serious collectors maintain a “sample library” of 100+ fragrances, owning full bottles of only 10-20 true loves.

Q: How do I determine which fragrance “families” I prefer?

A: Start with the four classical families:

(1) Fresh (citrus, aquatic, green)—clean, energizing, office-friendly.

(2) Floral (rose, jasmine, iris)—elegant, romantic, traditionally feminine but increasingly unisex.

(3) Oriental (amber, vanilla, spices)—warm, sensual, evening-appropriate.

(4) Woody (sandalwood, cedar, vetiver)—sophisticated, grounding, masculine. Test 2-3 fragrances from each family. You’ll naturally gravitate toward one to two families. Then explore sub-categories within those families.

Q: What’s “sillage” and “longevity”, and why do they matter?

A: Sillage (pronounced see-YAHJ) is the scent trail you leave—how far your fragrance projects. Longevity refers to the duration for which the fragrance remains detectable. Ideal combprioritizeary by context:

- Office: Low sillage / moderate longevity (don’t suffocate colleagues)

- Evening/Social: High sillage / long longevity (make an impression)

- Intimate: Low sillage / very long longevity (personal scent bubble)

Middle Eastern fragrances typically excel at longevity (12+ hours). French fragrances often prioritize elegant sillage over marathon longevity.

Final Recommendations: Your Strategic Starting Points

By Geographic Region:

North America:

- Luxury/Niche: Luckyscent (education and discovery) + Osswald NYC (ultra-premium)

- Value: FragranceNet (designer discounts)

- Speciality: Areej Le Doré (natural extremism)

United Kingdom:

- Luxury/Niche: Twisted Lily (consultation + British focus) + Roullier White (ultra-luxury)

- Heritage: Harrods (British classics)

- Value: Notino UK (post-Brexit still viable)

European Union:

- Luxury/Niche: Twisted Lily (ships EU) + Printemps (French authority)

- Value: Notino (unbeatable for EU residents)

- Speciality: Printemps (newest French releases)

Middle East & Asia:

- Regional: Al Haramain (authentic Middle Eastern perfumery)

- International: Luckyscent (ships globally) + Harrods (ships globally)

Australia/New Zealand:

- International Orders: Factor in high shipping costs and strict customs

- Best Value: FragranceNet (free shipping threshold achievable)

- Best Selection: Luckyscent (worth the shipping for rare finds)

By Budget Level:

Entry-Level ($50-150 per bottle):

- FragranceNet (designer fragrances at discount)

- Notino (EU residents—authorized retailer prices)

- Al Haramain (Middle Eastern quality at accessible prices)

Mid-Range ($150-300 per bottle):

- Twisted Lily (British and European niche, strong curation)

- Luckyscent (comprehensive niche selection)

- Notino (selective niche brands at competitive prices)

Premium ($300-600 per bottle):

- Luckyscent (Roja Dove, Xerjoff, Creed at MSRP)

- Roullier White (luxury with editorial context)

- Harrods (heritage British brands and exclusives)

Ultra-Luxury ($600+ per bottle):

- Osswald NYC (Clive Christian, Roja Haute Luxe, vintage rarities)

- Roullier White (artisanal exclusives and limited editions)

- Harrods (investment-grade fragrances and archives)

Building Your Fragrance Strategy

The global online fragrance market offers unprecedented access to exceptional perfumes from every corner of the world. The challenge isn’t scarcity—it’s curation and authentication.

Your strategic approach should balance three priorities:

- Education First: Sample extensively before committing to expensive bottles. Use discovery sets from Luckyscent and Twisted Lily as inspiration for your university project.

- Build Relationships: Choose 2-3 “home base” retailers matching your budget and aesthetic. Loyalty often yields VIP access, early release notifications, and consultation privileges.

- Diversify Sources: Use value retailers (FragranceNet, Notino) for designer fragrances and proven favourites. Reserve luxury boutiques (Luckyscent, Roullier White, Harrods) for niche exploration and special acquisitions.

The world’s finest fragrances are now accessible regardless of your location. This guide provides the roadmap—your olfactive journey is just beginning.